Solving the most annoying parts of billing

5 min. read

Aug 20, 2025

At Lark, we're building AI agents for billing operations. Lark helps subscription companies automate customer billing support inquiries and chargebacks. In this article, we talk about solving some annoying billing issues.

Billing Integrations Are Complicated

If you have ever built a billing integration, you’ll know that there is a lot more to it than simply defining your pricing and setting up a billing provider. As your product grows your billing integration has to account for a lot of things - free trials, discounts, price migrations, letting your customers switch plans mid cycle, supporting different countries & payment methods, etc.

A founder friend once told me how he set up billing in a few hours when he first started his company. A few months later one of the engineers on his team spent a week trying to migrate everyone to a new price. This goes on to show how things get complicated fast.

Although painful and time consuming, great engineers are often able to navigate this integration complexity. But billing problems don't just end once you have a robust integration built out. No matter how beautifully engineered your billing system is, there will always be some operational overhead associated with consumer billing. There are three categories that I think are the most annoying issues that no one wants to deal with. I’ll go through them one by one here.

Problem #1: Handling Billing Support Requests

If you're a B2C company offering subscriptions, chances are 30–35% of your total support volume is billing-related. These queries are either handled in house by a customer support person or outsourced to third party contractors. This person spends most of their time juggling between zendesk, billing provider, and internal dashboards to gather context and resolve tickets.

Some companies get excited and try to use a generic customer support tool to automate this workflow. Then they are disappointed in how bad these tools are at handling billing actions. This isn't unexpected - billing is nuanced and complex so you can't just throw a generic AI support layer on top of it.

The good news is that AI can still be good at handling billing issues if managed carefully. You need deep billing integrations so it can account for things like customer usage, prorations, credits, discounts, free trials, etc. You also need strong guardrails to ensure AI actions are safe.

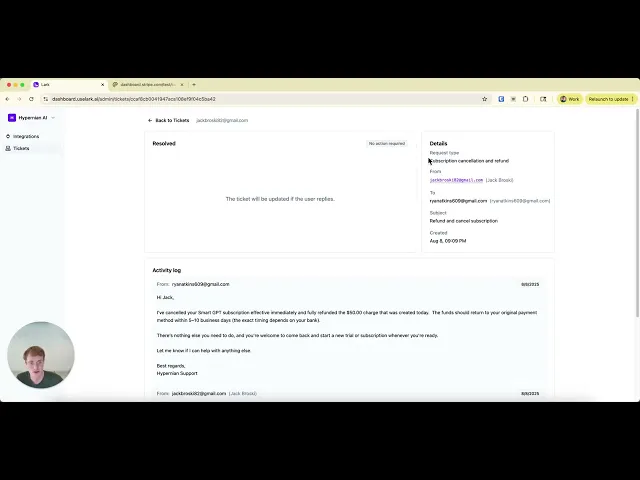

We build AI agents that can handle billing. If a user writes in asking for a refund because they forgot to cancel their subscription, we’re able to pull in the customer context (their usage, past payments, etc) and issue refunds if they haven’t used your service. We have guardrails around agent actions like only allowing refunds over the last 30 days and below a certain amount.

Agents can actioning requests immediately which increases customer satisfaction because they don't have to wait days to get a response. We also support a human in the loop workflow where AI drafts actions that you can approve in a single click.

Here are some additional things that you could to to minimize billing support volume in the first place:

Make subscription management simple. Users shouldn't have to dig through menus to cancel or update their plan. One clean, obvious spot in your UI makes a huge difference.

Create crystal-clear help docs. Include details on your refund policy, what happens when someone cancels (does it cancel immediately or end of billing period?), and when a refund is applicable.

Use a smart statement descriptor. Include a short URL to your customer portal so users can self-serve when they see the charge on their card. If you're using Stripe for billing then linking to their customer portal is a good idea.

Problem #2: Managing Payment Fraud and Chargebacks

Fraudsters love checkout pages. At some point you’ll become victim of a card testing attack which will cause a spike in fraudulent chargebacks. If you get too many chargebacks you might end up in a card network monitoring program which leads to increased fees and risk of being banned from card networks if fraud goes unchecked.

I remember once meeting a random founder at a SF event that complained about how annoyed he was dealing with fraud. He said something like - I'm using the checkout integration and sdks provided by my payment provider but it's my responsibility to keep fraud in check!? And if I become a victim of a fraud attack the provider kicks me off the platform?

Since then I have seen payment providers get better at mitigating fraud on their products but it is still ultimately your responsibility as a business to stay ahead of it. Here are some tips for that:

Follow best practices. For example, hiding your checkout page behind a sign up flow makes it harder for fraudsters to spam your checkout page.

Use fraud prevention tools like Stripe Radar. Radar is expensive but a valuable product. You should be monitoring fraud metrics and tuning radar rules on an ongoing basis.

Respond to chargebacks thoughtfully. Despite your best efforts you’ll always see some chargebacks. These should be <0.3% of your overall payment volume in a healthy scenario.

Contesting chargebacks is toilsome, so we also help companies with this. Our agents first reach out to the customer to try to resolve disputes out of band. If that fails, we create compelling evidence packets to contest disputes by accounting for for customer usage, their past payments and your terms & conditions.

To give you an idea of how this automation works, here are some screenshots of a recent subscription canceled dispute that our AI agents contested and won.

Problem #3: Preventing Product Misuse

If you offer free trials or discounts, users will find creative ways to abuse them and not pay you. A common example is customers spinning up endless free trial accounts. Cursor recently saw widespread abuse of their student free trial in some countries because customers could very easily spin up .edu email addresses.

Mitigating this usually involves using reliable third-party tools to track & verify customer identity. Something like Fingerprint can help prevent repeat users from gaming your free trials. If you're offering student discounts then SheerID is a common tool for verifying student identities.

These tools can sometimes still have gaps. For example, SheerID won’t completely guard against the issue that Cursor ran into. If you want to be strict about preventing misuse then you can have an added layer of detection built internally that takes into account the customer profile and usage patterns to classify accounts as fraudulent. This is similar to a human manually inspecting certain accounts to determine if they are suspicious. We also help companies with this.

Offloading Billing Operations

If you need assistance managing your billing operational overhead, have questions about customer billing, or just would like to chat about this space — we'd be happy to help. Our team has deep expertise in building and managing billing systems (we worked at Stripe for several years), and we are already managing billing operations for some large consumer AI companies.

If you're curious about how we do this, we integrate directly with your existing stack — including your:

Billing provider (e.g., Stripe, to get consumer billing info)

Data warehouse (e.g., Snowflake, to analyze customer profile and usage)

Customer support tools (e.g., Zendesk, to gather all customer communication)